MICA & Gaming in Web3: Are We Asking the Right Questions About Your Game’s Future in the EU?

A Guest Post by Torstein W. Thinn: Co-Founder and Chairman at Cointegrity

The promise of Web3 gaming is electrifying: tokenized economies, genuine player ownership, and sprawling metaverses. It’s a new frontier for interactive entertainment. Yet, as innovation gallops ahead, the European Union’s Markets in Crypto-Assets (MiCA) regulation has firmly entered the arena. A critical early question for any Web3 game developer eyeing the EU market, especially those whose games appeal to younger audiences, is how MiCA’s stringent Know Your Customer (KYC) requirements will function.

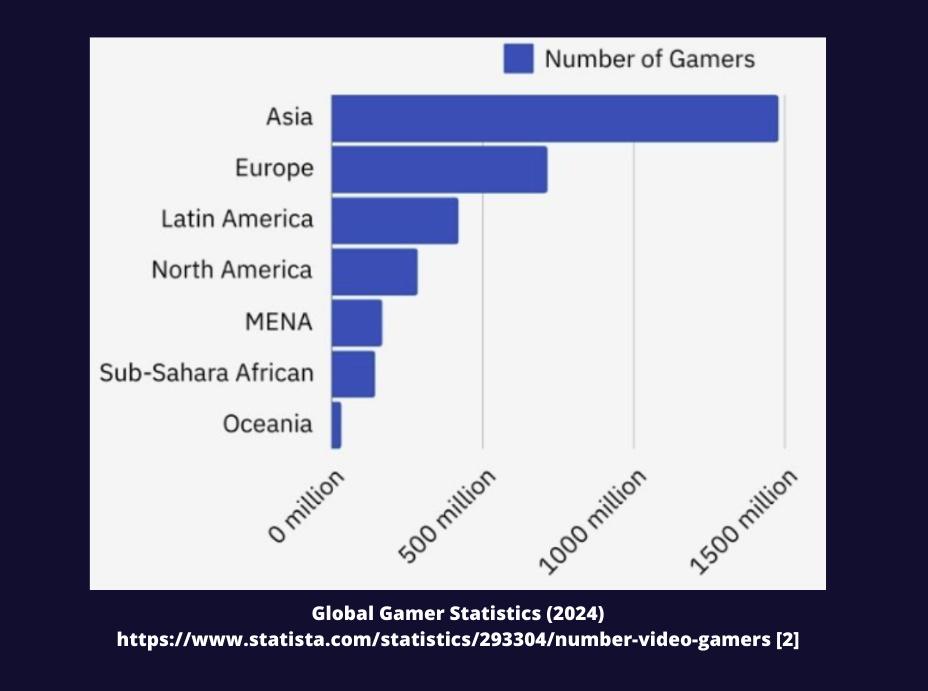

With traditional Virtual Asset Service Providers (VASPs) often mandating an 18+ age limit and government-issued IDs for verification[1], and with an estimated 20% of the 3.32 billion global gamers in 2024 (projected to be 3.51 billion in 2025) being under 18[2], the collision is imminent. While discussions often orbit around crypto exchanges and stablecoins, MiCA’s implications for the gaming world—particularly for those pioneering tokenization and immersive experiences—are profound, complex, and frankly, full of unanswered questions. If your game features tokens, NFTs, or virtual currencies, this isn’t just another compliance checklist; it’s about understanding the intricate regulatory maze and building a sustainable future for your vision.

The core tension is clear: MiCA aims to bring harmonized rules and consumer protection to a crypto space known for its rapid, often borderless, innovation. For game developers, this means foundational design choices about in-game economies or token utility now carry significant legal weight. But is the industry truly grappling with the trickiest questions this new reality poses?

The Known Unknowns: MiCA’s Basics for Gaming

We know MiCA, fully effective since December 30, 2024, is comprehensive. It demands clarity on:

● Token Classification: Is your in-game asset a utility token, an e-money token (EMT), an asset-referenced token (ART), or something else entirely? Getting this wrong isn’t a minor hiccup; it dictates your regulatory obligations. This requires a deep dive into your tokenomics and product design from the outset.

● Whitepapers: For many crypto-assets, a detailed whitepaper is mandatory, acting as a prospectus for users and regulators. Exemptions exist, but the threshold can be nuanced, especially for tokens funding development or carrying speculative value.

● AML/KYC Foundations: The intent to curb illicit activities through Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols is a cornerstone of MiCA. Even document-free verification methods are being explored to streamline this, but they must still meet AML standards.

These are the broad strokes. But the devil, as always, is in the details—and the details for global gaming are particularly devilish.

The Global Game: If Your Players Are Everywhere, Is MiCA Everywhere Too?

MiCA applies to those who “target” EU customers, regardless of where the game developer is based. To actively market to EU residents, establishing a legal entity within an EU member state becomes a necessity. This alone presents a significant hurdle for many international studios. The global nature of gaming, with Asia having 1.48 billion gamers and Europe 715 million, further complicates pinpointing where “targeting” occurs.

Distribution of gamers based on Region

Graph from: Global Gamer Statistics (2024)[2]

But what does “targeting” mean for an online game that’s inherently global? If your game is available in English, uses globally recognized payment rails, and doesn’t actively block EU IP addresses, are you “targeting” the EU? Or can you rely on “reverse solicitation,” where EU players find your game on their own initiative? The lines are blurry and fraught with risk. This ambiguity calls for a sophisticated regulatory strategy and licensing map, not assumptions.

Navigating this landscape means confronting stark national realities. Spain, for example, is fast-tracking MiCA compliance to December 30, 2025, yet the path to becoming a registered VASP is arduous and expensive, with a MiCA license potentially costing €30,000-€80,000. By the fourth quarter of 2024, the Bank of Spain’s register contained more than 122 organisations providing virtual asset services, a number that highlights the existing regulatory engagement even before MiCA’s stricter licensing regime fully bites. Germany’s BaFin adds another layer of complexity with its case-by-case analysis for classifying in-game tokens and determining if a BaFin license is needed based on whether tokens represent financial instruments or security-like assets, creating uncertainty where clear guidelines are sought by developers.

Further illustrating the diverse European regulatory landscape, Norway has provided early and specific guidance on cryptocurrency taxation, including the application of VAT to certain token sales. Other jurisdictions are also taking distinct approaches; Liechtenstein, for instance, established a comprehensive legal framework for the token economy with its Blockchain Act (TVTG), aiming to provide legal certainty for tokenization and acting as an early model. Concurrently, cities like Vienna are positioning themselves as attractive hubs for MiCA-compliant crypto businesses, with major exchanges establishing EU headquarters there, signaling a degree of regulatory competition and strategic localization within the continent.

The Elephant in the Gaming Room: KYC, AML, and Underage Players

Here’s where MiCA’s framework meets a fundamental reality of the gaming world: a significant portion of players are minors. Globally, an estimated 20% of the 3.32 billion gamers in 2024 are under 18[2]. Traditional Virtual Asset Service Providers (VASPs) often set an 18+ age limit for KYC, requiring government-issued IDs, and MiCA aims to harmonize these verification requirements across the EU[1]. How does this square with a game whose primary audience might be 13-17 years old?

● The ID Conundrum: Will teenagers need to submit passports or national ID cards to participate in a game’s tokenized economy? This is more than an inconvenience; it’s a potential colossal barrier to entry and a privacy concern for parents. What verifiable IDs can minors even provide for robust KYC, especially when “a pop-up asking ‘Are you over 18?’ is nowhere near sufficient” for regulated activities like gambling, which often requires strict verification?

● Child Protection vs. Financial Regulation: Gaming platforms are already navigating complex age verification for content appropriateness and data privacy under laws like GDPR (which has rules for “age of digital consent,” often 13-16, requiring parental consent below that age for data processing)[8] and the UK’s Online Safety Act, which demands “highly effective” age verification or estimation. These systems aim to protect minors. MiCA’s KYC/AML, however, is rooted in financial crime prevention[1]. Are these two objectives compatible at scale for youth-focused gaming? Can you implement MiCA-level KYC for a 14-year-old without overstepping data minimization principles or creating an unworkable user experience?

● Gameplay Segmentation: If full KYC is impossible for younger players, does this mean they are excluded from tokenized features, creating a two-tiered player base? Or must game designs fundamentally change to de-risk these interactions? These aren’t abstract legal puzzles; they strike at the heart of game design, community management, and tokenomics integration. The industry needs to ask: Are we designing systems that can realistically and ethically onboard younger users into regulated digital asset ecosystems? Even industry giants are wading into these waters. Sony has launched Soneium, an Ethereum Layer-2 network built with its joint venture Sony Block Solution Labs, aiming to integrate decentralized tech into its entertainment ecosystem, including gaming and NFT creation[9]. As these major players advance, solving the youth KYC challenge becomes even more critical.

NFTs in Gaming: Still a Wild West or MiCA’s Next Frontier?

Non-Fungible Tokens (NFTs) are generally considered unique and thus outside MiCA’s main scope if they truly represent distinct items like digital art.

However, MiCA itself warns that substance trumps form. If NFTs are issued in large, similar series, have traits similar to regulated asset types, or if their primary function leans toward investment or fungible exchange within a game, they could be pulled into MiCA’s orbit.

Germany’s BaFin, for example, may scrutinize the classification of NFTs on a case-by-case basis, alongside other token types[4]. The rise of “Hybrid NFTs,” linking digital tokens to real-world assets or experiences, further blurs these lines, aiming to provide tangible utility beyond speculation.

For games relying heavily on NFT collections for gameplay, progression, or economic activity, this isn’t a settled matter. It demands careful ecosystem audits and a design philosophy that considers regulatory perception from day one. The conviction from industry leaders is palpable. Yat Siu, Co-Founder of Animoca Brands, which recently announced plans for a Hong Kong/Middle East IPO to fund metaverse gaming, has framed NFTs as foundational to the future of digital economies. This vision aligns with Ubisoft’s bold Web3 moves, including its partnership with Immutable on Might & Magic: Fates, a Web3 strategy card game leveraging gas-free wallets for seamless integration. Nicolas Pouard, VP of Ubisoft’s Strategic Innovation Lab, emphasized the strategic intent behind the collaboration: “Digital ownership is the future – we’re bridging legacy IP with Web3 utility”. Justin Hulog, Chief Studio Officer at Immutable, underscored the compliance imperative, stating: “Seamless compliance is the bridge to mainstream adoption”, highlighting the delicate balance between innovation and regulatory alignment. Ubisoft’s Web3 efforts and Pouard’s role are further detailed in other reports.

Meanwhile, Sky Mavis, creator of Axie Infinity, continues to prioritize its Ronin blockchain despite a 21% staff reduction in late 2024 to streamline operations. CEO Trung Nguyen remains steadfast in his vision: “Open blockchain infrastructure is non-negotiable for true asset ownership”, a principle driving Ronin’s expansion into low-cost, high-scalability infrastructure for GameFi projects. These statements and partnerships reveal an industry grappling with MiCA’s ambiguities while betting heavily on interoperable ecosystems—where assets like NFTs transcend individual games to become pillars of broader digital economies.

Beyond the Letter of the Law: The Unspoken Challenges

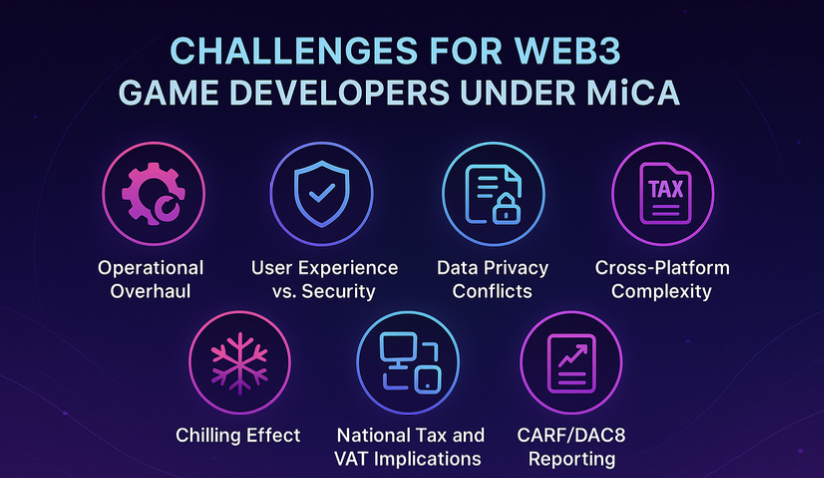

The conversation around MiCA often focuses on direct compliance. But for game developers, the ripple effects are vast:

● Operational Overhaul: Implementing robust KYC, AML, and transaction monitoring systems is a significant technical and financial undertaking, especially for studios accustomed to more agile, less formalized operations. This challenge is underscored by the fact that, as of the 29th of May 2025, only 25[16] of the EU’s hundreds of registered VASPs had successfully transitioned to MiCA compliance — a stark indicator of the hurdles even traditional crypto firms face, let alone gaming ecosystems

● User Experience vs. Security: How do you embed potentially cumbersome verification processes without destroying the fluid, immersive experience players expect? This is a critical UX focus point. Document-free verification methods show promise, but must still comply with AML regulations across various jurisdictions[1].

● The “Chilling Effect” vs. Legitimacy: Will the perceived complexity lead some developers to avoid tokenization altogether, or will embracing thoughtful regulation ultimately build greater trust and mainstream adoption? Theo Agranat, Director of Web3 at Gunzilla Games, acknowledged that “skepticism will always exist and for good reason” towards new Web3 gaming launches.

● Data Privacy Conflicts: The fundamental principle of data minimization under GDPR presents challenges when MiCA may mandate retaining transaction and KYC records for extended periods, potentially creating conflict in how user data is handled and stored[8].

● Cross-Platform Complexity: With the rise of cross-platform play and cloud gaming, determining jurisdiction and applying consistent compliance measures becomes even more challenging, especially when in-game currencies might be viewed under e-money or payments regulations.

● Varying National Tax and VAT Implications: Beyond MiCA’s direct scope, developers must navigate diverse national tax regimes. For example, Finland applies a standard VAT rate of 25.5% to B2C sales of digital products and services, which can include NFT sales or tokenized game features.

● Emerging International Reporting Frameworks: New tax transparency initiatives like the OECD’s Crypto-Asset Reporting Framework (CARF) and the EU’s DAC8 directive are set to impose significant reporting obligations on Crypto-Asset Service Providers (CASPs).

Game developers offering tokenized assets or in-game economies could fall under the definition of a CASP, requiring them to collect and report user transaction data to tax authorities, adding another layer of global compliance complexity.

Asking the Right Questions Is the First Step to Web3 Success

MiCA is here. But the pathway to compliant, engaging, and innovative Web3 gaming is not yet fully paved. Many of the toughest questions—about global reach, youth participation, and the true nature of in-game digital assets—are only now beginning to surface with the urgency they deserve.

There aren’t always easy answers. This evolving landscape underscores the need for more than just legal advice; it requires a holistic approach that blends strategic positioning, robust product solutions, meticulous tax and compliance mapping, and a clear vision for capital acceleration. It’s about anticipating the unasked questions, stress-testing assumptions, and building for a future where innovation and regulation can coexist. The game developers who engage with this complexity proactively, seeking to understand the nuances and discover their specific challenges, will be the ones who not only survive but thrive in the new era of regulated Web3 gaming.

About Cointegrity

We transform traditional businesses into Web3 leaders through innovative and impactful blockchain solutions. Our methodologies help you avoid common pitfalls while moving efficiently from concept to launch, accelerating your time-to-market. Our expertise spans strategic positioning, decentralized product development, go-to-market strategies, AI-powered solutions, Regulatory & Tax Compliance, and growth capital – delivering solutions that simplify complexity and amplify opportunity.

About the Author

Torstein W. Thinn, Co-Founder and Chairman at Cointegrity, is a financial innovator who established the world’s first cryptocurrency regulatory task force in 2019. Pioneered AI-driven trading strategies in 2004 when most considered it theoretical. As CFO (“Master of Coin”) at NBX, grew trading volume from 90M to 1.1B NOK and made NBX Europe’s first listed crypto exchange. As CEO at AKJ Group, oversaw trading infrastructure supporting $1.6B in traditional and crypto assets while implementing automation that reduced operational overhead by 50%. MSc Finance (NHH). Consistently ahead of industry curves—from quantitative modeling to regulatory frameworks.

References

1. MiCA Regulation Text: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32023R1114

2. Global Gamer Statistics (2024)

https://www.statista.com/statistics/293304/number-video-gamers

3. Spain’s MiCA Fast-Tracking: https://www.bde.es/f/webbde/SSICOM/20241230_criptoactivos.pdf

4. BaFin Token Classification Guidance: https://www.bafin.de/SharedDocs/Veroeffentlichungen/EN/Fachartikel/2018/fa_bj_1803_ICOs_en.html

5. Norway Cryptocurrency Taxation: https://www.skatteetaten.no/en/business-and-organisation/virksomhetsbeskrivelser/virtual-currency

6. Liechtenstein Blockchain Act (TVTG): https://www.gesetze.li/konso/2020.417

7. Vienna Crypto Hub Announcement: https://www.wien.gv.at/english/administration/press/releases/2024/09/30.html

8. GDPR Age of Consent: https://gdpr-info.eu/art-8-gdpr/

9. Sony Soneium Announcement: https://www.sony.com/en/SonyInfo/News/Press/202408/24-029E

10. Animoca Brands IPO Announcement: https://www.animocabrands.com/coverage

11. Ubisoft Web3 Partnership: https://www.ubisoft.com/en-us/company/about-us/investors#pressReleases

12. Sky Mavis CEO Statement: https://twitter.com/trungfinity/status

13. Finland VAT Guidelines: https://www.vero.fi/en/businesses-and-corporations/taxes-and-charges/vat/

14. OECD CARF Framework: https://www.oecd.org/en/topics/tax-transparency-and-international-co-operation.html

15. EU DAC8 Directive: https://taxation-customs.ec.europa.eu/taxation-policy/tax-co-operation-and-mutual-administrative-assistance/directive-administrative-cooperation-dac/dac8-new-rules-tax-transparency-crypto-assets_en

16. ESMA overview: https://www.esma.europa.eu/esmas-activities/digital-finance-and-innovation/markets-crypto-assets-regulation-mica

Recent Posts