Stablecoins and Secondary Markets: Transforming Gaming’s Black Markets into Monetized Ecosystems

The gaming industry has long battled an inherent challenge: the vast, valuable secondary trade of digital items, which historically thrives outside official channels. This unmanaged activity—involving gold farms, item resellers, and skin brokers—generates immense value for players but costs studios dearly through scams, account theft, chargebacks, fraud, and significant revenue leakage into grey markets.

With the global skins market alone estimated in the tens of billions of dollars, a meaningful share moves through unofficial venues. However, stablecoins are now providing the necessary infrastructure to legitimize this trade, transforming secondary markets from a risky externality into a durable engine for engagement and revenue.

The Problem: Unmanaged Trading and Revenue Leakage

Traditional game economies, even successful ones like FIFA Ultimate Team, CS:GO (Counter-Strike 2’s skins market is estimated at more than five billion dollars in 2024), and Pokémon GO, run into familiar constraints: weak or absent ownership, reliance on black-market intermediaries, and restricted monetization capabilities.

The lesson learned is not that trading is detrimental, but that unmanaged trading is expensive and risky for publishers and players alike. Studios struggle to capture value or enforce rules when activity moves off-platform.

[Stablecoins in Gaming – Chapter 1 Overview]

[Stablecoins in Gaming – Chapter 2 Overview]

Stablecoins: The Programmable Solution

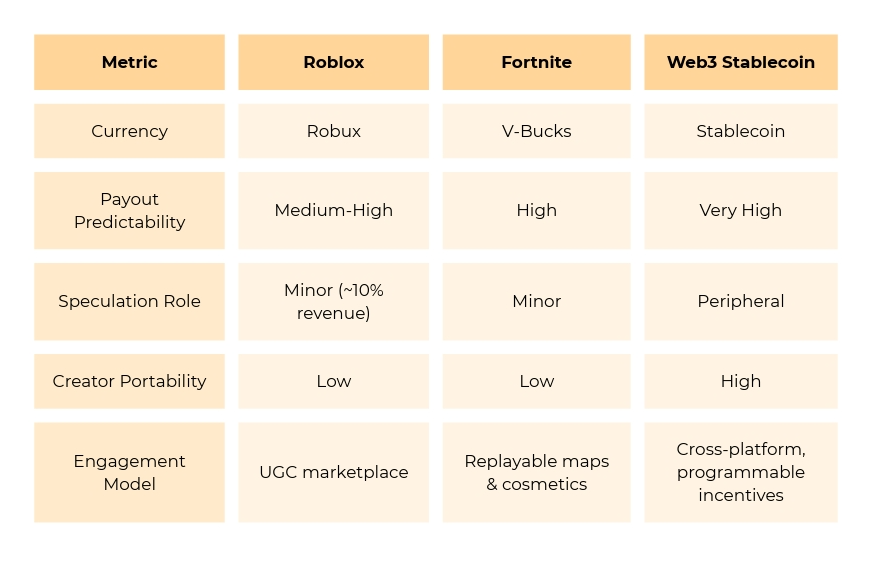

Stablecoins offer studios a practical solution to bring this valuable trading activity “inside the walls” of the game ecosystem. When assets reside on-chain and prices are denominated in a stable unit, several transformative benefits emerge:

1. Verifiable Peer-to-Peer Sales: Stablecoins enable transactions to be verifiable.

2. Enforced Royalties: Royalties are enforced directly in code via smart contracts, rather than being negotiated case by case.

3. Reduced Financial Risk: Settlement is final, drastically reducing issues like fraud and chargebacks.

4. Global, Fast Payouts: Payouts arrive quickly across borders, leveraging stablecoins’ inherent global reach.

5. Enhanced Compliance: Flows are auditable and can be gated behind Know Your Customer (KYC) requirements where necessary, significantly improving compliance.

This stability allows developers and creators to finally share in the value that previously escaped into shadow channels. As Amber Cortez, Head of Business Development at Sequence, explains, stablecoins are “transforming fragmented, speculative game economies into scalable, player-first systems”.

Implementing Monetized Ecosystems

Successfully transitioning a black market into a monetized ecosystem requires the right tooling and careful design choices.

Infrastructure Solutions: Infrastructure providers, such as Sequence, are key to running this model. They offer the “plumbing” to support:

• Embedded wallets and compliant marketplaces.

• Stablecoin settlement for in-game marketplaces.

• NFTs with customizable metadata and adjustable royalties, ensuring trades occur within the client rather than through external crypto flows.

By utilizing such infrastructure, development teams can test dynamic assets and stablecoin-denominated P2P sales without needing to overhaul their entire technical stack.

Design Principles for Sustainability: For secondary markets to be sustainable, design choices must prioritize market health over short-term gain:

• Pricing: Prices should track in-game desirability, not the volatility of a coin chart.

• Fees and Royalties: Take-rates should reflect real marketplace services, and royalty curves must avoid punitive cliffs that might drive users back to shadow channels.

• Clarity: Rarity requires clear supply and drop policies.

• Compliance Integration: KYC should apply dynamically only where regulation or high-value thresholds require it, rather than disrupting the everyday gameplay experience.

By focusing on these metrics—on-platform Gross Merchandise Volume (GMV) share, resale velocity, and fraud deltas—teams can fine-tune content and fees effectively.

Conclusion: A Durable Engine for Engagement

The industry now possesses a stable, programmable, and compliant rail to legitimize the trading activity that already happens post-purchase. Stablecoins ensure players maintain the freedom to sell their assets, while upgrading monetization for developers by aligning rewards with player effort and long-term engagement.

The end goal is a secondary market that is safer for players, clearer for regulators, and materially better for the developers and creators who contribute value. Stablecoins provide the predictability needed for this transition, moving gaming beyond speculative models and into an era of global, liquid, and composable economies.

Tags