New paradigm in gaming economic models

How many gaming models for crypto games do you know?

Gamers are promised to make real money by playing with play-to-earn. We’ve also seen play-to-airdrop, where dedicated players are rewarded with airdrops, and airdrops are used for token distribution. There are more obscure models for web3 games, like play-to-die that works like an arcade machine where you pay to play each time you die but can win big if you’re on top of player leaderboards. Each economic model aims to avoid rampant token inflation.

Generally speaking, most web3 games get their token prices up at the start by pure hype or hype based on the seemingly high quality of their games. Many address the inflation issue by creating elaborate tokenomics with an in-game token, a tradeable token, an action-specific token, etc. to balance supply and demand. And even with token staking on top, many games are struggling with inflation. Make no mistake, tokenomics are very difficult to design.

What if there was a new way of doing things? Consider this new paradigm in gaming economic models to address the challenge of token inflation: ultra sound games.

What are ultra sound games?

Imagine you are playing cards in a casino. At the end of every hand, the casino puts its rake (the scaled commission fee taken by the house for operating the game) in a wheelbarrow, carts it off to a furnace, and incinerates it.

This is exactly what ultra sound games do. By burning the rake in the context of a web3 game, ultra sound games provide a built-in deflationary mechanism to keep their economies sound.

Ultra sound games are games with immutably sound economies. Inspired by Ethereum Ultra-sound money, or currency with a higher burn rate than emission rate, ultra sound games have at least one very powerful built-in deflationary mechanism: burning of the rake.

Players benefit from ultra sound mechanisms even when they lose. Tokens that you lose playing the game are taken permanently out of circulation, meaning that the market cap for the coin is distributed over a smaller supply. The coins that you still hold thus become more valuable. And that’s true for all holders, not just the people who are playing.

That is a general idea, but there can be many specific applications for it. Below is an example to explain it further.

Ultra sound games, smart contracts, and token distribution

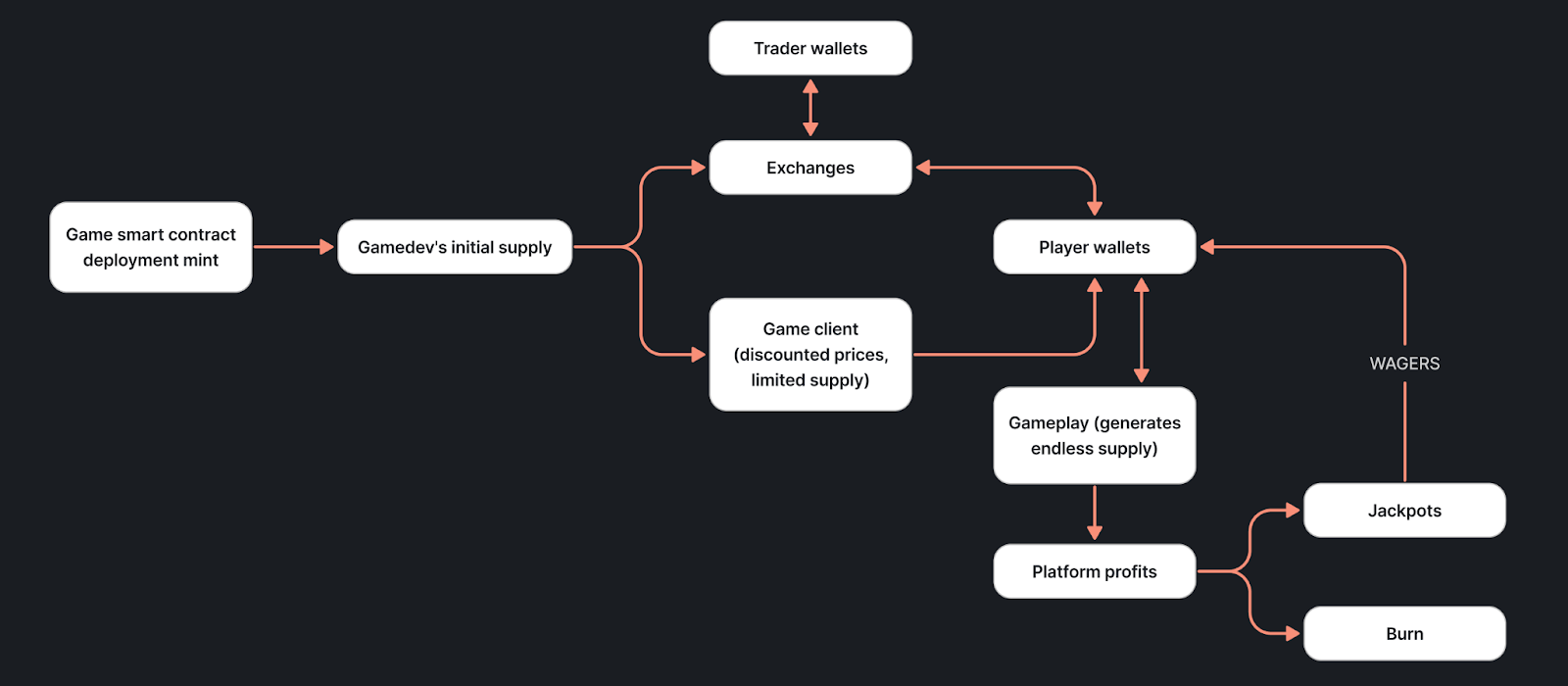

When an ultra sound game’s smart contract is deployed, it mints an amount of tokens to the deployer, to be used for bootstrapping purposes. Whoever deploys the contract gets that supply of token.

A portion of these tokens is distributed by the game developers to the players through the game client. They are sold to players at a discount, especially at moments in the game when having more tokens could be crucial to a player’s survival. This is also good for the economy because it makes it likely that the tokens will be used in the game instead of held in reserve as an investment. This discounted sale is limited in supply by the amount of tokens the developers of that game client have.

The game has a variable token supply. Unlike most ERC20 tokens, ultra sound games don’t have a fixed supply of tokens that is issued once and then distributed by a controlling party.

After the initial mint, tokens are issued and burned during gameplay. The smart contract does that based on game logic. This process happens continuously as long as the game is being played.

In this example, the game is fully on-chain and takes a rake on all moves. The rake, that a controlling party would normally take, is being burned. A percentage of all the money that the player spends in the game is being burned, and a percentage is going to the jackpot. Jackpots are won by players through playing or wagering.

When tokens get burned, the value of the remaining tokens increases. This guarantees that the token price remains high even after large sales.

Whenever someone plays, every holder wins.

All of this means that the tokens have a strong deflationary dynamic. But these are not deflationary tokens. It’s not that the supply is going down globally all the time. It’s that there’s a mechanic that controls inflation on the token. The inflation rate might not be negative, but the deflationary dynamic keeps the inflation rate low.

For people who are only interested in investment opportunities – you don’t have to interact with the game, you can opt to trade the tokens on exchanges.

What’s the catch?

The value of the token doesn’t just come from inflation and deflation. It also comes from market sentiment around the token, which might be very positive for a token with a lower inflation rate.

The more activity the game has, the higher the burn rate. Inflation slows down, but there is still high demand for the token. So the price goes up.

“The catch” is that to create high demand, you need to make good games with fun gameplay. Without a good game, none of this works.

This is the model that Moonstream decided to choose for the game we’re currently developing, Degen Trail. So would you choose ultra sound model for your game? How would you apply it? Would you like to know more details about the way it works?

This post was written by Daria N. Daria has been writing about the crypto space and blockchain gaming since 2021, conducting extensive web3 gaming research, and is an avid gamer herself.

Tags